Navigating the regulatory complexities of doing business in China is no easy feat, particularly when it comes to ensuring compliance with international sanctions. The Office of Foreign Assets Control (OFAC) 50 Percent Rule is a critical regulation that businesses must understand. This rule imposes sanctions not only on entities explicitly named on sanctions lists but also on those owned 50% or more by sanctioned individuals or entities.

While the rule is straightforward in theory, its application in China is complicated by opaque corporate ownership structures, indirect ownership layers, and the potential involvement of sanctioned entities. The only viable solution to ensure compliance and mitigate risks is to conduct thorough background investigations of Chinese companies, with a specific focus on legally verifying their ownership and affiliations.

Table of Contents

ToggleThe OFAC 50 Percent Rule: A Brief Overview

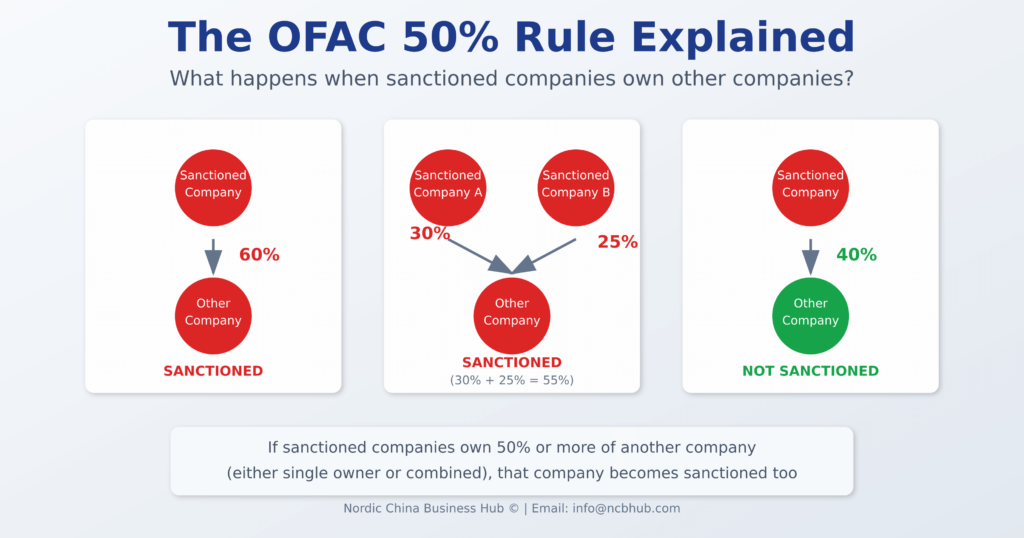

The OFAC 50 Percent Rule is designed to prevent sanctioned entities from evading restrictions through partial or indirect ownership of companies. Key aspects of the rule include:

- Ownership Threshold: A company is considered sanctioned if a single sanctioned individual or entity owns 50% or more of it. This applies even if the company itself is not explicitly listed on sanctions registries.

- Cumulative Ownership: If multiple sanctioned entities collectively own 50% or more of a company, the rule applies. For example, if two sanctioned individuals each own 25%, the company is blocked.

- Indirect Ownership: The rule extends to entities indirectly owned by sanctioned individuals or entities through multiple layers of corporate structures. For instance, if a sanctioned entity owns 50% of Company A, which in turn owns 50% of Company B, then Company B is also considered sanctioned.

The broad scope of the rule means businesses must carefully assess both direct and indirect ownership structures to avoid inadvertently engaging with sanctioned parties.

Why Background Investigations Are Essential

1. Opaque Ownership Structures in China

Chinese companies often operate with complex and layered ownership arrangements. These structures are designed to obscure the ultimate beneficiaries or controlling parties. Without proper investigation, businesses risk unknowingly engaging with entities linked to sanctioned individuals.

2. Indirect Ownership Risks

Indirect ownership is a significant challenge in China, where entities may be tied to sanctioned individuals through multiple layers of ownership. Tracing these connections requires expertise and access to verified corporate records.

3. Regulatory and Legal Risks

Failing to identify ownership links to sanctioned entities can result in severe penalties, including fines, frozen assets, and legal action. Conducting a comprehensive background investigation ensures that businesses can identify and address potential risks before entering into partnerships or contracts.

The Solution: Legally Verified Background Investigations

The complexities of the OFAC 50 Percent Rule make background investigations not just an option but a necessity. A legally verified background investigation provides the most reliable method for ensuring compliance. Here’s what such an investigation entails:

1. Access to Verified Corporate Records

Local experts, particularly Chinese legal professionals, can access verified corporate databases and government filings. These records reveal the true ownership structure of a company, including indirect and cumulative ownership links.

2. Identification of Hidden Connections

Background investigations trace ownership through multiple tiers to uncover any ties to sanctioned entities. This process ensures that no hidden risks are overlooked.

3. Compliance with Chinese Laws

Foreign businesses must adhere to local legal and regulatory requirements when conducting investigations. Chinese legal experts ensure that all investigations comply with domestic laws, reducing the risk of legal disputes.

4. Authentication of Documents

Investigators verify the authenticity of corporate records and filings to ensure that the information is accurate and reliable. This step is critical in cases where entities may attempt to misrepresent their ownership structures.

Consequences of Skipping Background Investigations

Failure to conduct a background investigation can have severe consequences, including:

1. Legal Penalties

OFAC violations can lead to significant fines, legal action, and, in some cases, criminal charges. Businesses that fail to comply with the 50 Percent Rule may face audits and increased regulatory scrutiny.

2. Financial Losses

Non-compliance can result in frozen payments, canceled contracts, and disrupted supply chains. Businesses may also incur costs related to litigation and rebuilding partnerships.

3. Reputational Damage

Engaging with a sanctioned entity, even inadvertently, can tarnish a company’s reputation. This loss of trust can deter future partners and investors.

4. Operational Disruptions

A relationship with a sanctioned entity can lead to blocked transactions and halted operations, jeopardizing business continuity.

5. Loss of Market Access

Non-compliance can result in restrictions on accessing key markets, limiting growth opportunities for businesses that rely on Chinese partnerships.

How to Conduct a Background Investigation

A comprehensive background investigation involves several key steps:

1. Engage Chinese Legal Professionals

Local legal experts are indispensable for accessing verified corporate records and understanding the nuances of Chinese regulations. They can navigate complex ownership structures and uncover indirect links to sanctioned entities.

2. Trace Ownership Layers

Investigators analyze direct and indirect ownership structures to identify cumulative ownership and hidden connections. This includes examining subsidiaries, affiliates, and other related entities.

3. Verify Corporate Records

Legal experts authenticate corporate filings and documents to ensure accuracy. This step is critical for identifying potential misrepresentation or forgery.

4. Document Findings

Maintain detailed records of the investigation, including corporate ownership structures and any identified risks. This documentation is vital for demonstrating due diligence and compliance.

Real-World Example

A U.S. manufacturing company planned to partner with a Chinese supplier to expand its operations. However, a legally verified background investigation revealed that the supplier was indirectly owned by a sanctioned entity through multiple layers of subsidiaries. Without the investigation, the company would have violated OFAC regulations, leading to potential fines and reputational harm.

By conducting the investigation, the company avoided:

- Legal penalties.

- Operational disruptions.

- Damage to its global reputation.

This case underscores the importance of thorough due diligence and legally verified background investigations when operating in China.

Conclusion

The OFAC 50 Percent Rule is a critical regulation that businesses cannot afford to overlook. In China, the complexities of corporate ownership structures make it impossible to rely solely on superficial checks or sanctions screening tools. The only effective solution is to conduct a legally verified background investigation of potential Chinese partners.

By working with Chinese legal professionals to uncover ownership structures, verify records, and identify hidden risks, businesses can ensure compliance, avoid penalties, and protect their operations. In an increasingly complex regulatory landscape, investing in thorough due diligence is not just a best practice—it is a business imperative.

Compliance is an ongoing process, and background investigations are the foundation of that effort. Make them a standard part of your strategy when entering or expanding in the Chinese market.

FAQ: Understanding OFAC’s 50 Percent Rule and the Need for Background Investigations in China

1. What is OFAC’s 50 Percent Rule?

The Office of Foreign Assets Control (OFAC) 50 Percent Rule is a regulation that blocks companies owned 50% or more by sanctioned individuals or entities. The rule applies even if the company itself is not explicitly listed on sanctions registries. It also considers cumulative and indirect ownership to determine compliance.

2. Why is the OFAC 50 Percent Rule important for businesses in China?

China’s corporate environment often involves opaque ownership structures and indirect ownership layers, making it challenging to identify connections to sanctioned entities. Non-compliance with the rule can lead to severe legal, financial, and reputational consequences for foreign businesses.

3. What happens if a business violates the OFAC 50 Percent Rule?

Consequences of violations include:

- Legal penalties: Fines, legal action, or even criminal prosecution.

- Financial losses: Frozen payments, disrupted supply chains, and canceled contracts.

- Reputational damage: Loss of trust among partners, customers, and investors.

- Operational disruptions: Blocked transactions and halted operations.

- Loss of market access: Restrictions on entering or operating in critical markets.

4. Why are background investigations necessary for Chinese companies?

China’s corporate ownership structures are often complex and layered, making it difficult to identify ultimate ownership. Background investigations uncover:

- Direct and indirect ownership links.

- Cumulative ownership stakes involving multiple sanctioned parties.

- Hidden connections through affiliates or subsidiaries.

Without proper investigation, businesses risk unknowingly engaging with sanctioned entities.

5. Can sanctions screening tools replace background investigations?

No. While sanctions screening tools are helpful for identifying explicitly listed entities, they cannot uncover:

- Indirect ownership through layered structures.

- Cumulative ownership by multiple sanctioned parties.

- Hidden affiliations through subsidiaries or related entities.

Background investigations are essential for a complete understanding of ownership risks.

6. What does a legally verified background investigation involve?

A legally verified background investigation typically includes:

- Accessing and analyzing verified corporate records.

- Tracing direct, indirect, and cumulative ownership layers.

- Identifying links to sanctioned individuals or entities.

- Authenticating corporate filings to ensure accuracy.

- Documenting findings to demonstrate compliance efforts.

7. Who should conduct background investigations for Chinese companies?

Background investigations should be conducted by Chinese legal professionals who:

- Have access to local corporate databases and government filings.

- Understand the nuances of Chinese laws and regulations.

- Can navigate the complexities of ownership structures.

8. What are the risks of not conducting a background investigation?

Businesses that fail to investigate ownership structures may face:

- OFAC violations: Resulting in fines and legal action.

- Unforeseen partnerships: With entities tied to sanctioned parties.

- Reputational harm: From publicized violations.

- Operational risks: Disrupted supply chains and blocked transactions.

9. How can indirect ownership trigger sanctions?

Indirect ownership occurs when a sanctioned entity owns a significant stake in one company, which in turn owns another company. For example:

- A sanctioned entity owns 50% of Company A.

- Company A owns 50% of Company B.

- Under the 50 Percent Rule, Company B is also considered sanctioned.

10. How often should background investigations be conducted?

Ownership checks should be conducted:

- Before entering a partnership: To identify initial risks.

- Regularly throughout the relationship: To monitor changes in ownership or new sanctions designations.

11. What documentation should businesses maintain after a background investigation?

Maintain detailed records of:

- Corporate ownership findings.

- Legal filings and documentation analyzed.

- Decisions made regarding partnerships.

- Communication with legal experts and compliance teams.

These records demonstrate good-faith compliance efforts.

12. Are cumulative ownership stakes always obvious?

No. Cumulative ownership stakes can involve multiple sanctioned parties, each holding smaller percentages that collectively exceed 50%. Background investigations are necessary to uncover these relationships.

13. Can businesses rely on their own due diligence for compliance?

Internal due diligence can help, but it is often insufficient in China’s complex regulatory environment. Businesses should engage local legal experts to ensure investigations are thorough and legally compliant.

14. How do Chinese legal professionals add value to background investigations?

Chinese legal professionals:

- Have access to verified corporate records and government databases.

- Understand local regulations and how to navigate them.

- Can authenticate documents and filings.

- Provide detailed insights into complex ownership structures.

15. What industries are most at risk under the 50 Percent Rule?

Industries with high exposure to global transactions, such as:

- Finance.

- Importing/exporting.

- Real estate.

- Insurance.

- Manufacturing with international supply chains.

16. How can businesses ensure compliance with OFAC regulations?

The most effective way to ensure compliance is to:

- Conduct a legally verified background investigation for every potential partner.

- Engage Chinese legal experts for ownership verification.

- Maintain thorough documentation of all investigations and findings.

- Regularly update compliance processes to reflect new regulations.

17. Can minority stakes by sanctioned entities be a concern?

Yes. Although the 50 Percent Rule applies at the 50% threshold, minority stakes can still pose compliance risks, especially if the sanctioned party exerts significant influence. Businesses should exercise caution and investigate thoroughly.

18. How can businesses stay updated on OFAC sanctions?

- Subscribe to updates from OFAC and other regulatory bodies.

- Work with compliance teams and legal experts to monitor changes.

- Use updated screening tools to identify newly sanctioned entities.

19. What is the key takeaway for businesses operating in China?

The only reliable way to comply with the OFAC 50 Percent Rule is to conduct a legally verified background investigation of potential Chinese partners. This process ensures that ownership structures are transparent, risks are identified, and compliance is maintained.

20. What should I do if a background investigation reveals a connection to a sanctioned entity?

- Immediately consult with legal experts to assess the risk.

- Avoid entering or continuing the partnership.

- Document findings and decisions to demonstrate compliance efforts.

- Notify relevant authorities if required.

Conducting a legally verified background investigation is not just a regulatory requirement—it is a business necessity to safeguard against legal, financial, and reputational risks.